Introduction: A New Era for Insurance Underwriting

The insurance industry is undergoing a revolutionary transformation, thanks to the integration of AI and machine learning in insurance. These technologies are redefining traditional underwriting processes, enabling insurers to assess risks with unprecedented accuracy. As AI and machine learning in insurance continue to evolve, they are not only enhancing operational efficiency but also paving the way for more personalized and fairer insurance policies.

AI and Machine Learning: A Paradigm Shift in Risk Assessment

AI and machine learning in insurance have introduced a paradigm shift in how risks are assessed. Traditionally, underwriting relied heavily on historical data and broad demographic factors. However, with AI’s ability to analyze vast datasets in real-time, insurers can now evaluate individual risks with greater precision. This shift towards data-driven underwriting allows for more accurate pricing models and reduces the likelihood of human error.

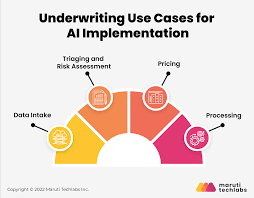

Enhancing Operational Efficiency with AI Automation

The implementation of AI in insurance underwriting has significantly enhanced operational efficiency. Routine tasks that once required manual intervention, such as data collection and risk analysis, can now be automated. This automation not only speeds up the underwriting process but also frees up human underwriters to focus on more complex cases that require expert judgment. As a result, insurers can process applications faster and reduce operational costs.

Personalization and Fairness in Insurance Policies

One of the most significant impacts of AI and machine learning in insurance is the ability to create more personalized and fair policies. By analyzing individual behaviors, preferences, and risk profiles, insurers can tailor policies that better reflect the needs of their customers. This personalized approach not only improves customer satisfaction but also promotes fairness by ensuring that policyholders are charged premiums that accurately reflect their risk levels.

Addressing Challenges and Ethical Considerations

While the benefits of AI and machine learning in insurance are clear, there are also challenges and ethical considerations to address. The use of AI in underwriting raises concerns about data privacy and the potential for biased algorithms. Insurers must ensure that their AI systems are transparent and that they adhere to strict ethical standards. Additionally, regulators will play a crucial role in overseeing the use of AI in insurance to protect consumers from potential harms.

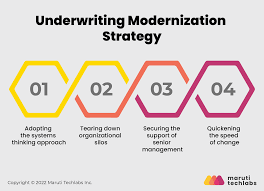

The Future of Insurance Underwriting

The future of insurance underwriting will undoubtedly be shaped by AI and machine learning. As these technologies continue to advance, we can expect even greater levels of accuracy and efficiency in risk assessment. Moreover, the integration of AI with other emerging technologies, such as blockchain and the Internet of Things (IoT), will further revolutionize the industry. Insurers who embrace these innovations will be better positioned to meet the evolving needs of their customers.

Conclusion: Embracing the AI Revolution in Insurance

The impact of AI and machine learning in insurance underwriting cannot be overstated. These technologies are driving a fundamental shift in how risks are assessed, policies are priced, and operations are managed. As the insurance industry continues to evolve, embracing AI will be essential for insurers looking to remain competitive in an increasingly data-driven world.