Insurance fraud remains a significant challenge in the industry, leading to billions in losses annually. The role of blockchain in insurance fraud prevention has gained traction as a promising solution to enhance transparency and security. By leveraging blockchain technology, insurers can mitigate fraudulent activities, streamline operations, and improve overall trust in the insurance ecosystem.

Understanding Blockchain Technology

Blockchain technology is a decentralized ledger that records transactions across multiple computers in a secure and immutable manner. Each block in the chain contains a list of transactions, and once added, it is nearly impossible to alter or delete. This characteristic of blockchain is crucial in combating insurance fraud, as it provides a transparent and tamper-proof record of all transactions.

Enhancing Transparency with Smart Contracts

One of the key advantages of blockchain in insurance fraud prevention is the use of smart contracts. These self-executing contracts with the terms of the agreement directly written into code eliminate the need for intermediaries. Smart contracts automatically execute and enforce terms based on pre-defined conditions, reducing the opportunities for fraudulent claims and ensuring that all parties adhere to the agreed-upon terms.

Improving Data Accuracy and Integrity

Blockchain technology ensures data accuracy and integrity by providing a single, immutable version of the truth. For insurers, this means that claims, policy details, and historical data are consistently accurate and transparent. By maintaining a comprehensive and unalterable record of all relevant data, insurers can more easily detect inconsistencies and anomalies that may indicate fraudulent activity.

Streamlining Claim Verification Processes

Fraudulent claims often involve manipulating or falsifying information. Blockchain’s decentralized nature allows for real-time verification of claims across multiple parties. This streamlined process not only speeds up claim resolution but also reduces the chances of fraudulent claims slipping through the cracks. Insurers can cross-reference claims with historical data and verify their legitimacy quickly and efficiently.

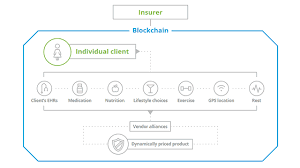

Enhancing Collaboration Among Stakeholders

The role of blockchain in insurance fraud prevention extends to improving collaboration among various stakeholders, including insurers, brokers, and policyholders. By providing a shared, transparent platform, blockchain facilitates better communication and coordination. This enhanced collaboration helps prevent fraudulent activities by ensuring that all parties have access to the same information and can independently verify the authenticity of transactions.

Real-World Applications and Case Studies

Several insurers have already begun exploring and implementing blockchain technology to combat fraud. For instance, certain companies are using blockchain to create decentralized networks where all policyholders and insurers can verify each other’s credentials and claim history. These real-world applications demonstrate the practical benefits of blockchain in enhancing fraud prevention and maintaining the integrity of the insurance industry.

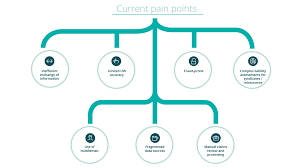

Challenges and Future Prospects

While blockchain offers significant potential for fraud prevention, there are challenges to address. The technology is still evolving, and integrating blockchain with existing systems can be complex and costly. Additionally, widespread adoption requires industry-wide collaboration and standardization. However, as the technology matures and more insurers adopt blockchain solutions, the benefits are expected to outweigh the challenges, leading to a more secure and transparent insurance landscape.

Conclusion

The role of blockchain in insurance fraud prevention is transformative, offering enhanced transparency, data accuracy, and streamlined processes. By adopting blockchain technology, insurers can significantly reduce fraudulent activities, improve operational efficiency, and build greater trust within the industry. As blockchain continues to evolve, its potential to revolutionize fraud prevention in insurance becomes increasingly apparent.