As global environmental changes accelerate, the future of climate insurance is rapidly evolving. Insurers are facing unprecedented challenges as they adapt their policies and strategies to address the increasing frequency and severity of climate-related risks. Climate insurance adaptation is becoming crucial for protecting both individuals and businesses from the financial impacts of extreme weather events, rising sea levels, and other climate-related hazards. This evolution in insurance practices reflects a broader shift towards more resilient and forward-thinking risk management approaches.

The Impact of Climate Change on Insurance

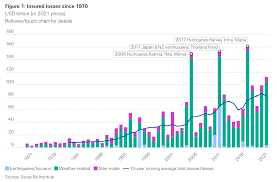

Climate change is reshaping the insurance landscape, pushing insurers to reconsider traditional risk models. The increase in the frequency and intensity of natural disasters, such as hurricanes, floods, and wildfires, has led to higher claims and financial losses. As climate-related events become more common, insurers must adapt their risk assessment processes to account for these new realities. Climate insurance adaptation involves leveraging advanced data analytics, integrating climate models, and developing innovative coverage options to address the specific needs of affected regions. Insurers are increasingly recognizing the necessity of incorporating climate projections into their underwriting processes to better predict and manage potential risks.

Innovative Insurance Products for a Changing Climate

In response to the growing climate risks, insurers are developing innovative products designed to provide more comprehensive coverage. One such product is parametric insurance, which offers payouts based on predetermined triggers like wind speeds or rainfall amounts. This approach simplifies the claims process, ensuring timely payouts and reducing the administrative burden on both insurers and policyholders. Additionally, insurers are exploring climate-linked bonds and reinsurance solutions to manage their exposure to catastrophic events more effectively. These innovations reflect a broader trend towards more flexible and responsive insurance solutions that can better accommodate the uncertainties associated with climate change.

The Role of Technology in Climate Insurance

Technology is playing a pivotal role in the future of climate insurance. Insurers are increasingly using advanced technologies such as artificial intelligence (AI) and machine learning to enhance risk assessment and pricing accuracy. AI algorithms can analyze vast amounts of climate data to identify patterns and predict potential risks with greater precision. Machine learning models help insurers refine their risk models and improve their ability to forecast future climate scenarios. Geographic Information Systems (GIS) also play a crucial role by mapping and assessing climate risks in detail. These technological advancements enable insurers to offer more tailored and effective coverage options, ultimately improving the resilience of their portfolios.

Challenges and Opportunities in Climate Insurance

Despite the advancements, the path to effective climate insurance adaptation is fraught with challenges. One major issue is the difficulty in predicting and quantifying the impacts of climate change, which can lead to uncertainties in pricing and coverage. For example, estimating the potential damage from a future hurricane involves numerous variables, making accurate pricing complex. Additionally, there is a need for greater collaboration between insurers, governments, and scientists to develop and implement effective climate risk management strategies. However, these challenges also present opportunities for innovation and growth in the insurance sector. By addressing these issues, insurers can not only mitigate risks but also create new business models that align with evolving environmental realities.

Future Trends in Climate Insurance

Looking ahead, several key trends are likely to shape the future of climate insurance. First, there will be a greater emphasis on sustainability and resilience, with insurers increasingly focusing on promoting environmentally friendly practices and supporting climate adaptation efforts. This shift includes incorporating sustainability criteria into underwriting processes and offering incentives for policyholders to engage in climate-positive behaviors. Second, the use of blockchain technology may become more prevalent, providing greater transparency and efficiency in the insurance process. Blockchain’s decentralized nature can enhance data security and streamline claims processing. Lastly, the expansion of insurance coverage to include emerging climate risks, such as those related to biodiversity loss, will become more common. Insurers will need to adapt their policies to address the full spectrum of environmental challenges and support broader efforts to protect ecosystems and natural resources.

The Role of Government and Regulation

Government policies and regulations will also play a critical role in shaping the future of climate insurance. As the impacts of climate change become more pronounced, governments are likely to implement stricter regulations and standards for insurance coverage related to environmental risks. This could include requirements for insurers to disclose their exposure to climate risks and their strategies for managing those risks. Regulatory frameworks may also incentivize insurers to develop more sustainable and climate-resilient products. Collaboration between the insurance industry and policymakers will be essential in creating effective regulations that balance the needs of insurers with the broader goals of climate adaptation and resilience.

The Path Forward for Insurers

To successfully navigate the evolving landscape of climate insurance, insurers must remain agile and proactive. This involves continuously updating their risk models, investing in new technologies, and fostering collaborations with stakeholders across various sectors. By embracing innovation and focusing on climate insurance adaptation, insurers can not only protect their own interests but also contribute to a more resilient and sustainable future. As the insurance industry continues to evolve in response to climate change, the ability to adapt and respond to emerging risks will be key to its success.