Introduction: The Rising Challenge of Climate Change

Climate change is no longer a distant concern; it’s an imminent reality that impacts various facets of our lives, including the insurance industry. As global temperatures rise and weather patterns become more unpredictable, the cost of insuring homes, businesses, and lives is steadily increasing. The relationship between climate change and insurance premiums is complex, involving a multitude of factors that are driving up costs and reshaping the industry. Understanding how climate change influences insurance premiums is crucial for both insurers and policyholders.

The Direct Impact of Climate-Related Disasters

One of the most direct ways climate change influences insurance premiums is through the increased frequency and severity of natural disasters. Events such as hurricanes, floods, wildfires, and droughts have become more common, leading to a surge in insurance claims. As insurers face higher payouts, they pass these costs onto consumers in the form of higher premiums. In regions particularly prone to climate-related disasters, the impact is even more pronounced. Policyholders in these areas may find themselves paying significantly more for coverage as insurers attempt to mitigate their risks.

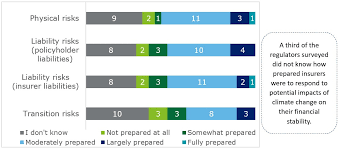

The Role of Risk Assessment in Premium Calculation

Insurance companies rely heavily on risk assessment models to calculate premiums, and these models are being profoundly affected by climate change. Traditional models, which were based on historical data, are becoming less reliable as climate patterns shift. Insurers are now incorporating new data and advanced analytics, including climate models, to better predict future risks. However, this increased complexity in risk assessment often leads to higher premiums. As insurers account for the growing uncertainty associated with climate change, the cost of coverage inevitably rises.

The Influence of Regulatory and Policy Changes

Government policies and regulations related to climate change are also influencing insurance premiums. As governments introduce stricter building codes, flood zone maps, and environmental regulations, the cost of compliance for property owners increases. These additional costs are often reflected in higher insurance premiums. Furthermore, some governments are introducing mandatory insurance requirements for certain climate risks, such as flood insurance in high-risk areas, which can further drive up premiums. Insurers must navigate this evolving regulatory landscape while balancing the need to remain profitable.

The Economic Impact of Climate Change on Insurers

Climate change not only affects the cost of individual premiums but also has broader economic implications for the insurance industry as a whole. The increased frequency of claims and the need for larger reserves to cover potential losses are straining the financial resources of insurance companies. This financial pressure can lead to higher premiums across the board as insurers seek to maintain profitability. Additionally, some insurers may choose to withdraw from high-risk markets altogether, reducing competition and leading to further premium increases.

Adaptation Strategies for Insurers and Policyholders

Both insurers and policyholders must adapt to the changing landscape brought about by climate change. Insurers are investing in new technologies, such as satellite imagery and artificial intelligence, to improve risk assessment and pricing models. They are also exploring alternative risk transfer mechanisms, such as catastrophe bonds, to spread risk more effectively. On the other hand, policyholders can take proactive steps to reduce their risk exposure, such as investing in resilient building materials, implementing flood defenses, and adopting sustainable practices. These measures can help mitigate the impact of climate change on insurance premiums.

Conclusion: Navigating the Future of Insurance in a Changing Climate

The influence of climate change on insurance premiums is undeniable and will likely continue to grow as the effects of climate change become more pronounced. Both insurers and policyholders need to be aware of these changes and take steps to adapt. For insurers, this means developing more sophisticated risk models and exploring new ways to spread risk. For policyholders, it means understanding the risks they face and taking proactive measures to protect themselves. As the world continues to grapple with the challenges of climate change, the insurance industry will play a crucial role in helping society navigate an increasingly uncertain future.