Telematics in auto insurance represents a groundbreaking shift in how insurance policies are crafted and priced, emphasizing a data-driven approach that rewards safe driving behaviors. By integrating technology and data analytics, telematics in auto insurance enables a more personalized assessment of risk, which can lead to more accurate and fair pricing. This approach not only benefits drivers who practice safe driving but also enhances the overall efficiency and effectiveness of insurance companies. Understanding how telematics works and its implications can help drivers make informed decisions about their insurance policies and potentially save money.

Understanding Telematics Technology

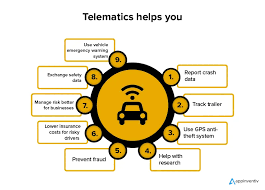

Telematics in auto insurance involves the use of advanced technology to monitor and analyze driving behaviors. This technology typically includes devices installed in vehicles or smartphone applications that collect data on various aspects of driving, such as speed, acceleration, braking patterns, and mileage. The collected data is then transmitted to insurance companies, where it is analyzed to evaluate driving habits. This real-time data provides insurers with a detailed understanding of how safely a driver operates their vehicle, allowing for more precise risk assessment. For instance, a driver who consistently follows speed limits and demonstrates smooth braking may benefit from lower premiums, reflecting their safer driving habits.

How Data-Driven Policies Benefit Safe Drivers

One of the primary advantages of telematics in auto insurance is its ability to offer a more equitable pricing model based on individual driving behavior. Traditional insurance models often rely on broad statistics and historical data to determine premiums, which may not accurately reflect a driver’s current risk level. Telematics, on the other hand, uses real-time data to assess risk more accurately. Safe drivers are rewarded with lower premiums, creating a financial incentive to maintain good driving practices. This not only encourages safer driving but also helps drivers save money on their insurance premiums. By aligning premiums with actual driving behavior, telematics ensures that drivers are rewarded for their safe driving habits rather than penalized by generalized risk assessments.

The Impact on Insurance Premiums

Telematics data enables insurers to tailor insurance premiums to the specific risk profile of each driver. This personalized approach contrasts with traditional models that use broad demographic and historical data to determine rates. By analyzing detailed driving data, insurance companies can adjust premiums more accurately. For example, drivers who exhibit low-risk behaviors, such as smooth acceleration and gentle braking, may experience a reduction in their insurance costs. Conversely, drivers who display risky behaviors, such as frequent hard braking or excessive speeding, might face higher premiums, reflecting their increased risk. This data-driven approach allows for more precise risk assessment and promotes fairness in insurance pricing.

Privacy and Data Security Concerns

While telematics in auto insurance offers significant benefits, it also raises important concerns about privacy and data security. The collection and analysis of driving data involve handling sensitive information, which necessitates robust security measures. Insurers must ensure that the data collected through telematics devices or apps is protected from unauthorized access and misuse. Additionally, transparency is crucial in addressing privacy concerns. Drivers should be informed about how their data is collected, stored, and used, and they should have the option to consent to or opt-out of data collection. By addressing these concerns and implementing strong security protocols, insurers can build trust with their customers and mitigate potential privacy risks.

The Future of Telematics in Auto Insurance

Looking ahead, the role of telematics in auto insurance is expected to expand as technology continues to evolve. Future advancements may include more sophisticated data analytics, enhanced integration with other smart vehicle technologies, and even more personalized insurance policies. For instance, advancements in artificial intelligence could lead to more accurate risk assessments and better predictions of driving behavior. Additionally, the integration of telematics with other smart technologies, such as advanced driver-assistance systems (ADAS), could provide even more comprehensive insights into driving patterns. As telematics technology continues to progress, it is likely to offer even greater benefits to both insurers and drivers, further improving the accuracy and fairness of auto insurance pricing

Conclusion

Telematics in auto insurance is revolutionizing the way insurance companies assess risk and determine premiums. By leveraging technology and data analytics, insurers can create more personalized and equitable pricing models that reward safe driving behaviors. While privacy and data security remain important considerations, the benefits of telematics in promoting safe driving and providing fairer insurance pricing are significant. As technology continues to advance, the future of telematics in auto insurance promises even greater opportunities for enhancing the accuracy and effectiveness of insurance policies. For drivers, embracing telematics technology can lead to both financial savings and a safer driving experience.

To read more articles like this click here.