In the wake of the COVID-19 pandemic, mental health insurance has become a critical topic of discussion. The pandemic has brought to light the significant impact of mental health on overall well-being, leading to a surge in demand for mental health services. As a result, there has been a notable shift towards expanding mental health insurance coverage. This expansion reflects a growing recognition of the importance of mental health and the need for comprehensive support systems. As we navigate a post-pandemic world, understanding the evolution of mental health insurance is crucial for ensuring access to necessary resources.

The Rising Need for Mental Health Services

The COVID-19 pandemic has had a profound effect on mental health worldwide. Many individuals have experienced increased levels of anxiety, depression, and other mental health challenges. The isolation, economic uncertainty, and overall stress associated with the pandemic have exacerbated these issues. According to recent studies, the prevalence of mental health conditions has risen significantly, highlighting the urgent need for accessible mental health services.

Historically, mental health services were often limited or excluded from standard insurance plans. The stigma surrounding mental health and the lack of awareness about its impact contributed to this gap in coverage. However, the pandemic has accelerated a shift towards recognizing mental health as a critical component of overall health. This shift has driven the expansion of mental health insurance coverage, with more plans now including a range of mental health services.

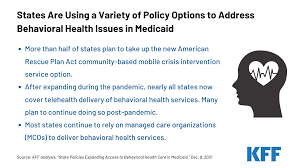

Policy Changes and Enhanced Coverage

One of the most significant changes in mental health insurance post-pandemic is the broadening of coverage. Insurers are now offering more comprehensive plans that include coverage for therapy sessions, psychiatric care, and mental health medications. This expansion is a response to the increased demand for mental health support and a recognition of the importance of addressing mental health issues early on.

For instance, many insurance plans now cover a greater number of therapy sessions per year and provide coverage for a wider range of mental health professionals, including psychologists and licensed clinical social workers. Additionally, there is a growing emphasis on covering medications prescribed for mental health conditions, which can be a substantial financial burden for many individuals.

Telehealth and Its Impact on Mental Health Coverage

Telehealth has emerged as a crucial tool for accessing mental health care during the pandemic. With lockdowns and social distancing measures in place, many individuals turned to telehealth services for therapy and counseling. This shift to virtual care has proven to be highly effective, offering flexibility and convenience for both patients and providers.

Recognizing the benefits of telehealth, many insurance companies have integrated telehealth services into their mental health coverage. This inclusion ensures that individuals can continue to receive care without needing to visit a physical location. For those in rural or underserved areas, telehealth provides access to mental health professionals who might otherwise be unavailable.

Moreover, the integration of telehealth into insurance plans has made mental health services more accessible to a broader population. It has also encouraged the adoption of innovative technologies that enhance the delivery of care, such as secure video conferencing and mobile health apps.

Addressing Gaps in Coverage

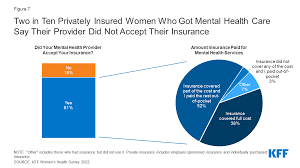

Despite the progress in expanding mental health insurance, there are still gaps that need to be addressed. Some insurance plans may offer limited coverage for mental health services or exclude certain types of treatments. For example, coverage may be restricted to a set number of therapy sessions or may not include alternative therapies that some individuals find beneficial.

Geographic disparities in mental health coverage can also be a concern. Insurance plans may vary significantly depending on the region, leading to unequal access to mental health services. To address these gaps, ongoing advocacy and policy adjustments are necessary to ensure that mental health insurance provides equitable access to care for all individuals.

Additionally, there is a need for greater transparency in mental health insurance policies. Clear information about coverage limits, out-of-pocket costs, and provider networks can help individuals make informed decisions about their mental health care.

The Future of Mental Health Insurance

As we look to the future, the evolution of mental health insurance will likely involve further innovations and enhancements. The understanding of mental health continues to evolve, and insurance companies will need to adapt their policies to reflect new research and best practices.

Future developments in mental health insurance may include expanding coverage for preventive care and early intervention. There may also be a focus on integrating mental health services with primary care to provide a more holistic approach to health. Additionally, insurers may explore new models of care, such as collaborative care programs that involve multiple providers working together to address mental health needs.

The ongoing commitment to improving mental health insurance is essential for supporting overall public health and well-being. By addressing existing gaps and embracing innovative approaches, mental health insurance can play a pivotal role in ensuring that individuals receive the support they need to thrive in a post-pandemic world.

To read more articles like this click here.